Navigating the complex ecosystem of climate-resilient financing

Many risks, many opportunities

How can businesses, governments, and society – all of us – avoid the tremendous recovery costs that accompany climate-related natural disasters? Well-crafted, climate-resilient investments have the potential to help mitigate or avoid recovery costs, and ensure that those costs don’t undermine future economic growth and human welfare. In addition, these investments can sometimes lead to new economic opportunity, which can benefit savvy organizations, investors, and communities. These principles are embedded within the recommendations of the Task Force on Climate-related Financial Disclosure.

As the strength and frequency of climate-related disasters continue to increase, we need to support and facilitate greater investments to mitigate the impacts of these storms in the future. A growing body of research shows large benefit-to-cost ratios of a wide range of resilience measures, including a study by our colleagues on the benefit-to-cost ratios of coastal protection measures.

The value of resilience is expected to grow due both to increasing exposure of vulnerable populations and to a changing climate. The Climate Science Special Report, released last week, updates the scientific consensus that greenhouse gas emissions are creating a future climate that is different than the past, thus increasing some of the hazards that vulnerable populations will face.

Case in point: rising sea levels as a result of climate change. The number of people living in low elevation coastal zones around the world is estimated to increase at least 50% over the next few decades. Many of these people live in poverty, in poorly constructed homes. And, most suffer from shoddy or non-existent public services called for in the Sustainable Development Goals including clean water, effective healthcare, well-maintained roads, and reliable electricity.

These factors underscore the need to address the physical, financial, and legal risks that climate change poses to a wide variety of existing and planned investments. Every major sector of the economy is exposed to these risks. If no action is taken, global incomes could decline more than 20 percent by 2100, relative to a world without climate change. And, virtually no organization or sector is immune to this potential economic drag.

Making Strides Towards Resilience

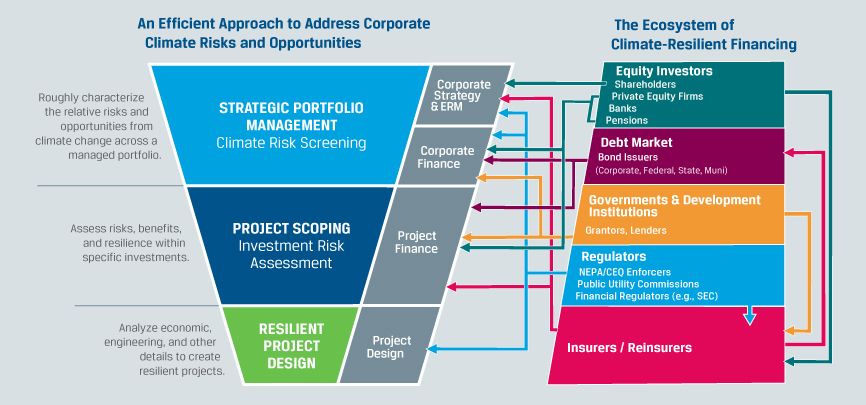

However, there is hope. As the diagram above shows, climate change needs to be considered at all levels of decision-making, from portfolio management to project scoping to resilient project design. Smart climate-risk management uses an efficient, tiered approach to identify and address risks at each level. This approach is being championed by the World Bank, the U.S. Agency for International Development, and a growing array of companies. It utilizes rapid climate risk screening at the top level and increasingly detailed risk and opportunity analyses at subsequent levels.

Some characteristics of an effective approach to addressing risks are:

- Effectiveness. It identifies the most important risks and opportunities. Missing or mischaracterizing these risks and opportunities could be have consequences of millions or even billions of dollars.

- Salience. It dovetails with existing decision-making processes, providing decision makers with the information they need, packaged in ways that are easily usable.

- Efficiency. It is rapid and nimble in order to keep pace with the often short time frames of investment decision-making. It should also be tiered in order to first understand the high-level, strategic risks and avoid overspending on analyzing things that are not at risk.

- Credibility and Transparency. It is based on the best available science and its conclusions need to be traceable to credible sources.

These principles can help to ensure that critical risks are identified and appropriate risk mitigation measures are identified and executed. It can also help maximize so-called “resilience dividends.” Take, for example, investments in the wake of hurricane destruction that replace centralized fossil fuel-based energy systems with distributed energy resources (DERs). This approach emphasizes the use of renewables, which doesn’t just support resilient electricity supply in the aftermath of the next major storm, but also increases overall access to electricity.